Your mindset shapes every aspect of your life, including your relationship with money. It’s not just about how much you earn, but how you think about and manage the resources you have. A healthy money mindset isn’t cultivated overnight; it’s a garden that needs constant tending.

Understanding Your Money Mindset

The journey to financial clarity begins with introspection. Ask yourself, how do you view money? Is it a source of stress or a tool for empowerment? Do you see it as a means to an end or an end in itself? These questions are crucial because they influence your financial decisions at a subconscious level.

Shifting Perspectives

For many, money is synonymous with anxiety. But what if we shifted that perspective? Imagine viewing money as a friend rather than a foe, as a resource that can help achieve your dreams rather than a hurdle to overcome. This shift in perspective is the first step towards developing a positive money mindset.

The Power of Positive Financial Habits

Developing a positive money mindset also involves establishing healthy financial habits. This means setting aside time for regular financial check-ins, creating and sticking to a budget, and educating yourself on financial products and investment strategies. It’s about making peace with your past financial mistakes and seeing them as valuable lessons rather than failures.

Visualization and Goal Setting

Visualization is a powerful tool in cultivating a positive money mindset. Picture your financial goals clearly. Whether it’s becoming debt-free, owning a home, or building a retirement nest egg, visualizing these goals makes them more tangible and attainable. Pair this with specific, measurable, achievable, relevant, and time-bound (SMART) goals to pave your path to success.

Embracing a Mindset of Abundance

An abundance mindset focuses on the possibilities and opportunities that money can bring, rather than the limitations. It’s about recognizing that with the right strategies and decisions, there can be more than enough to go around. This mindset encourages taking calculated risks and investing in yourself and your future.

Conclusion

Your money mindset is the bedrock upon which your financial house is built. By cultivating a positive relationship with money, you’re not just preparing for a future of wealth; you’re also enjoying a present filled with financial peace and confidence. In the next section, we’ll explore how to translate this mindset into practical, everyday money management strategies. Stay tuned as we continue to unlock the secrets of financial success, one mindset shift at a time.

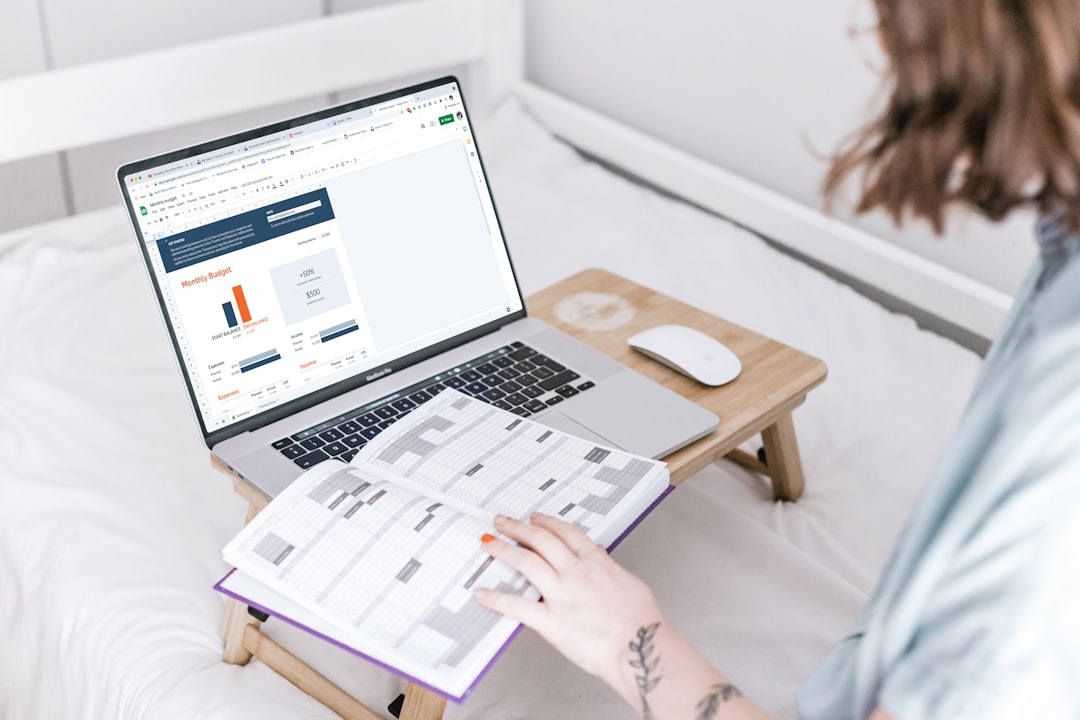

Budgeting

by Sincerely Media (https://unsplash.com/@sincerelymedia)

The first step to achieving financial wellness is creating a budget. This involves tracking your income and expenses and setting limits for your spending. Start by listing all of your sources of income, including your salary, investments, and any side hustles. Then, make a list of all your expenses, including bills, groceries, and discretionary spending. Use a budgeting app or spreadsheet to help you keep track of your spending and make adjustments as needed.

Saving

Saving money is an essential part of financial wellness. It’s important to have an emergency fund to cover unexpected expenses and to save for long-term goals such as retirement. Aim to save at least 10-15% of your income each month. You can also automate your savings by setting up automatic transfers from your checking account to your savings account.

Investing

Investing is a great way to grow your wealth and achieve financial stability. Consider investing in a diverse portfolio of stocks, bonds, and real estate. If you’re new to investing, it’s a good idea to consult with a financial advisor who can help you create a personalized investment plan based on your goals and risk tolerance.

Money Mindset

by Didier Weemaels (https://unsplash.com/@didwee)

Your mindset plays a crucial role in your financial wellness. It’s important to have a positive attitude towards money and to avoid negative thoughts and beliefs that may hold you back. Practice gratitude for what you have and focus on your financial goals. Surround yourself with people who have a healthy money mindset and can provide support and encouragement.

Tax Planning: Strategizing for a Brighter Financial Future

Tax planning is an important aspect of managing your finances. By planning ahead, you can minimize your tax liability and potentially save money. Consider consulting with a tax professional to help you understand your tax situation and identify any deductions or credits you may be eligible for. It’s also a good idea to keep track of your expenses and receipts throughout the year to make tax season easier.

Taxes are as certain as the sunrise, yet many of us approach them reactively rather than proactively. Tax planning is the art of analyzing your financial situation from a tax perspective, with the aim to ensure tax efficiency. Through careful planning, you can ensure that all elements of your financial plan work together in the most tax-efficient manner possible.

Understanding the Basics

Tax planning involves understanding how different financial decisions can affect your tax bill. It’s about knowing the nuances of tax laws and leveraging them to minimize the amount of tax you pay. We’ll break down the basics, so you’re not left scratching your head when tax season rolls around.

Maximizing Deductions and Credits

One of the keys to effective tax planning is making the most of the deductions and credits available to you. We’ll guide you through common deductions and credits that can help reduce your taxable income and lower your tax liability.

Investment Tax Implications

Your investment decisions play a significant role in tax planning. From retirement accounts to capital gains, we’ll explore how to make smart investment choices that align with your tax planning strategies.

Planning for Life’s Milestones

Major life events can have significant tax implications. Whether you’re buying a home, starting a business, or saving for college, we’ll discuss how to plan for these events in a tax-efficient way.

Staying Ahead of Changes

Tax laws are ever-changing, and staying informed is crucial. We’ll provide updates on recent tax law changes and discuss strategies for adapting your tax planning to these changes.

Effective tax planning is an ongoing process that can help you maximize your financial resources. It’s not just about saving money on taxes this year but about setting up a strategy that will benefit your financial wellness for years to come. Stay tuned as we continue to unravel the complexities of tax planning, ensuring you’re equipped to make informed decisions that will keep your finances healthy and thriving.

Financial Education: Empowering Your Financial Freedom

by Ian Schneider (https://unsplash.com/@goian)

One of the best ways to achieve financial wellness is by educating yourself about money management. There are many resources available, including books, podcasts, and online courses. You can also attend workshops or seminars offered by financial institutions or community organizations. By continuously learning about money topics, you can improve your financial literacy and make informed decisions about your finances.

By implementing these tips and strategies, you can take control of your finances and achieve financial wellness. Remember to stay positive and be patient with yourself as you work towards your goals. With the right mindset and knowledge, you can achieve financial stability and peace of mind.

Building a Strong Foundation

Just like building a house, a strong financial future requires a solid foundation. We’ll start with the basics—budgeting, saving, understanding credit, and managing debt. These are the building blocks that will support your financial house, no matter how grand it becomes.

Navigating the Financial Landscape

The financial world can be complex, with its ever-evolving products, services, and regulations. Financial education helps you navigate this landscape with confidence, understanding the routes that can lead to success and the pitfalls to avoid.

Investing in Knowledge

Investing isn’t just about stocks and bonds; it’s also about investing in your own financial education. We’ll explore how continued learning and staying informed about financial trends can pay dividends in the long run.

Tools and Resources

There’s a wealth of tools and resources at your disposal, and knowing how to use them can enhance your financial literacy. From books and online courses to seminars and workshops, we’ll guide you to the best resources for deepening your financial knowledge.

Making It Personal

Financial education is not a one-size-fits-all endeavor. It’s personal. Your financial goals and circumstances are unique, and your educational path should reflect that. We’ll help you tailor your learning to fit your personal financial situation and goals.

Conclusion

Armed with financial education, you’re empowered to take control of your financial destiny. Whether you’re planning for retirement, saving for a big purchase, or simply trying to stretch your monthly budget, the knowledge you gain from financial education is a tool that will help you build a life of financial wellness. Stay with us as we continue to explore the vital role that financial education plays in achieving and maintaining financial health.

References

Enhancing your financial education is a journey that can be supported by numerous high-quality resources. In the USA, there are many platforms, institutions, and services dedicated to improving financial literacy for individuals at all stages of life. Here are some references where you can find valuable information and education on financial matters:

- Government Resources:

- U.S. Financial Literacy and Education Commission (MyMoney.gov): This website offers tools and resources to help consumers make informed financial decisions.

- Consumer Financial Protection Bureau (CFPB): The CFPB provides educational materials on financial management, loans, credit, and more.

- Educational Institutions:

- Smart About Money (National Endowment for Financial Education – NEFE): Offers free courses and workshops on a variety of financial topics.

- FINRA Investor Education Foundation: Provides research and educational programs aimed at improving the financial knowledge of individuals and communities.

- Non-Profit Organizations:

- JumpStart Coalition: Focuses on advancing financial literacy among students in pre-kindergarten through college.

- Council for Economic Education (CEE): Provides economic and financial education resources to K-12 teachers and students.

- Libraries and Online Platforms:

- Khan Academy: Offers personal finance resources as part of its broader educational mission.

- Lynda.com (LinkedIn Learning): Provides courses on financial literacy, personal finance, and investment.

- Books and Publications:

- “The Index Card: Why Personal Finance Doesn’t Have to Be Complicated” by Helaine Olen and Harold Pollack: A book that simplifies the foundations of sound financial decision-making.

- “The Financial Diet: A Total Beginner’s Guide to Getting Good with Money” by Chelsea Fagan: Offers a fresh perspective on how to cultivate a healthy financial life.

- Podcasts and Blogs:

- “The Clark Howard Podcast”: Offers practical advice on saving more, spending less, and avoiding rip-offs.

- “The Penny Hoarder”: A blog that shares unique job opportunities, personal stories, freebies, and more.

- Online Forums and Communities:

- r/personalfinance on Reddit: A community where individuals share advice and experiences related to personal finance.

- Bogleheads.org: An online community with forums focused on investment advice and financial news.

- Financial Planning Tools:

- Mint: A popular budgeting tool that helps track spending and monitor financial accounts.

- Personal Capital: Offers tools for financial planning and wealth management.

- Workshops and Seminars:

- Local Community Colleges and Adult Education Centers: Often offer personal finance workshops for community members.

- Financial Planning Association (FPA): Hosts events and workshops for individuals looking to learn more about financial planning.

By utilizing these resources, you can build upon your financial knowledge and make more informed decisions that align with your personal and financial goals. Remember, the pursuit of financial education is a lifelong endeavor that can lead to lasting financial wellness.